Pullan's Pieces #118 - August 2016-China In-Licensing deals, China Biotech push, competition in Generics

Pullan's Pieces #118

August 2016

linda@pullanconsulting.com | 1(805)-558-0361 | www.PullanConsulting.com

Global BD News and Analysis for Biotech and Pharma

Dear Reader,

If you like this newsletter, please sign up to get a monthly email.

SIGN UP HERE TO RECEIVE THESE MONTHLY NEWSLETTERS DIRECTLY IN YOUR INBOX

https://www.robly.com/subscribe?a=09d720be69e6cff000f5ff54cdae0b0b Or send me a note at linda@pullanconsulting.com

Each month, I try to explore at least one topic with some analysis. In the last two issues, I focused on neuroscience. This time, I've looked at China companies doing product in-licensing deals. Next time could be your favorite topic -- just let me know what that might be! Hope you have had a lovely summer and are ready for the jump back into the hubbub with the fall!

Cheers,

Linda

Table of Content:

- China In-licensing In geographic

- Signs of China Biotech push

- Big pharma principles and partnering

- Not enough competition in Generics

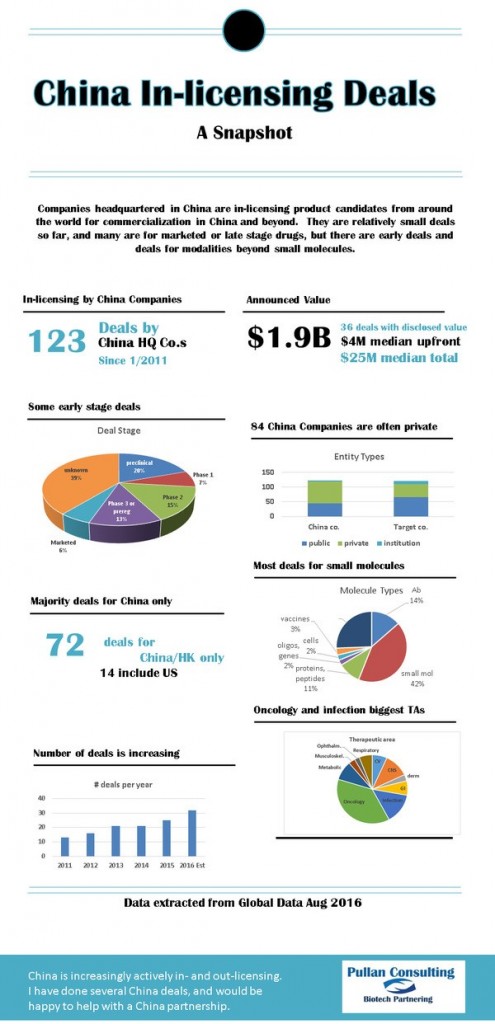

China In-Licensing Infographics

Signs of China's Biotech push

Chinese companies (state owned Greenland, Agile Group, Ping An Trust, Poly Sino-Capital) are investing $1b in a South San Francisco biotech park.http://www.dealstreetasia.com/stories/chinas-greenland-ping-an-agile-to-invest-1b-in-us-biotech-site-50946/

China's hot IPO Shenzen market has made a billionaire of the CEO of JaffronBiomedical. China is home to the 2nd most billionaires, after the US.http://www.forbes.com/sites/russellflannery/2016/08/15/pharma-entrepreneur-becomes-chinas-newest-billionaire-as-stocks-reach-7-month-high/#543aa602e3b1

WuXi PharmaTech ($WX) is marching ahead with plans to join in a $250 million venture fund (WuXi Healthcare Venture Fund II) aimed at U.S. and China life sciences companies. http://www.fiercebiotech.com/biotech/updated-wuxi-healthcare-plots-a-250m-biotech-venture-fund-for-u-s-china.

Big pharma drug discovery principles and partnering

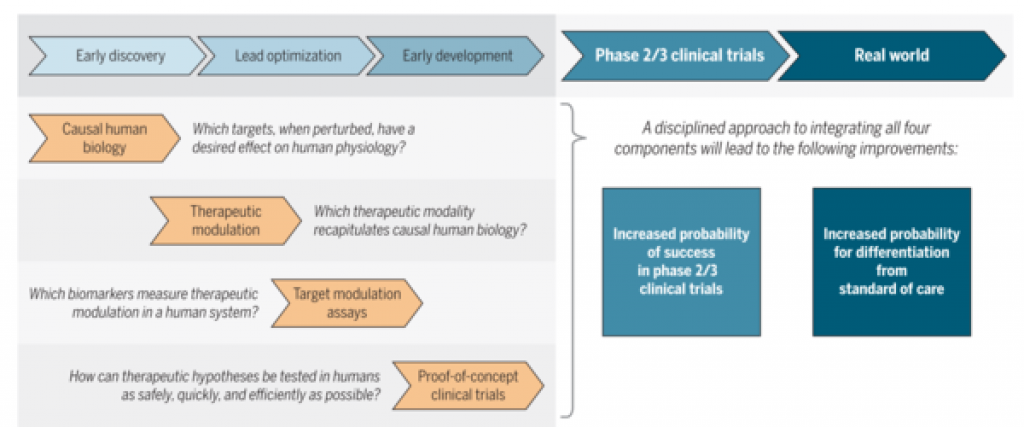

Robert Plenge of Merck has written a well-argued paper on the pharma thinking about careful drug discovery. http://stm.sciencemag.org/content/scitransmed/8/349/349ps15.full.pdf

For better probability of success later, you need human data to validate the target, that the target must be addressable, with biomarkers for its modulation, and a small short clinical trial must be feasible.

Derek Lowe commented on the fact that requiring human biology understanding of the target certainly limits drug discovery to the most studied areas, not necessarily where there is an unmet medical need. For example, Alzheimer's does not fit this pharma model of drug discovery. And it is very hard to find areas that meet all 4 of the principles in the figure above. http://blogs.sciencemag.org/pipeline/archives/2016/08/16/rules-for-modern-drug-development

Some of the comments on Derek's post (see Kelvin's) point out that the required level of knowledge to meet these principles means you won't be innovative, that in most cases the competition will be stiff as everyone can see the same basic science establishing the human validation of the target. I agree.

But from my partnering perspective, I think the most important message of the Science article is that this is how big pharma thinks. If you bring them something that does not fit this paradigm, that arose from something other than a well-validated target, you have a higher burden of data and persuasion. If you are really doing innovative work, you are probably taking risks that big pharma would not take themselves. This probably means that to partner with big pharma, you need more data (perhaps robust human data) than if you were bringing them data against a target that meets these principles of drug discovery. And you want to come with thinking of biomarkers and clinical trial designs.

We have a clear exposition of how big pharma wants drug discovery and early development to look like. If we do it differently, we have to reduce the risk with more data to increase the probability of partnering with big pharma.

Not enough Competition in Generics

SHORTAGES:

The European Association of Hospital Pharmacists says more than four out of five of its members face regular shortages, while doctors in Canada have been grappling this year with tight supply of a widely-used epilepsy drug. http://www.reuters.com/article/us-health-medicine-shortages-insight-idUSKCN0WY3NT

SHORTAGES:

The European Association of Hospital Pharmacists says more than four out of five of its members face regular shortages, while doctors in Canada have been grappling this year with tight supply of a widely-used epilepsy drug. http://www.reuters.com/article/us-health-medicine-shortages-insight-idUSKCN0WY3NT

In the US, shortages include penicillin, analgesics, cancer drugs, anesthetics, products needed for cardiovascular and psychiatric emergencies, and even IV electrolytes.

FASTER FDA REVIEWS

Generics launched in 2015 took 4 years for approval and less than 2% were approved on their first submission.

For drugs in shortage, the FDA prioritized the review of 383 drug applications and supplemental drug applications from January 2010 through July 2014. 240 (63%) of those priority reviews were for generic sterile injectable drugs. But the review time still averages at least a year for these prioritized ANDAs.

LOW PROFITS

Generic injectables are prone to shortage because of low profit margins and high production costs. http://www.nytimes.com/2016/05/31/upshot/drug-prices-too-high-sometimes-theyre-not-costly-enough.html?_r=0

SLOW and EXPENSIVE APPROVAL

Generics launched in 2015 took 4 years for approval and less than 2% were approved on their first submission.

Scott Gottlieb, former FDA deputy commissioner, says that in 2003, it cost an estimated $1M to file a generic drug application and consequently a generic selling more than $5M would attract competition as a logical investment. Today, the average cost is $5M and it takes $25M in sales to attract competition. Thus, infrequently used generics may have only 1 manufacturer and cost as much as branded drugs. http://www.wsj.com/articles/how-obamas-fda-keeps-generic-drugs-off-the-market-1471645550

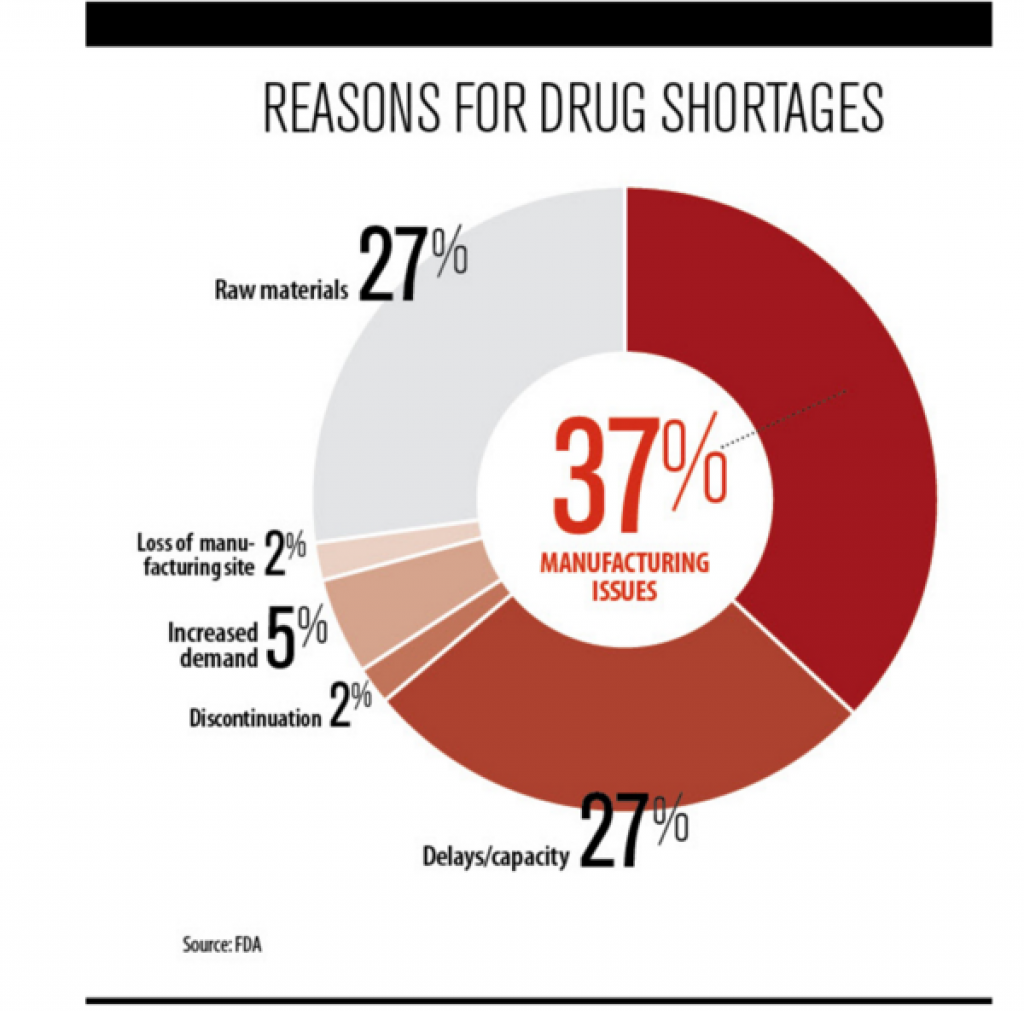

Manufacturing the Biggest difficulty in approval

The FDA analysis of reasons for shortages concentrates on supply.

FEW MANUFACTURERS

According to the GAO report, 71 percent of all generic injectable cancer drugs sold in 2008 were produced by just three manufacturers. http://fortune.com/2015/01/06/the-u-s-has-a-drug-shortage-and-people-are-dying/

MULTIPLE COMPETITORS LOWER PRICES

One FDA study estimated that consumers pay 94% of a branded drug for a generic with only one source but 40% of the branded drug price if there are 4 generic competitors and 20% of the branded price if there are 8 suppliers.http://www.wsj.com/articles/how-obamas-fda-keeps-generic-drugs-off-the-market-1471645550

MANY DRUGS HAVE NO GENERICS

JAMA had a report sampling of 417 novel therapeutics, to find that 210 were eligible for generic competition, but 36 (17%) had no generic drugs approved, 174 (83%) had one or more generic and 133 (63%) had four or more. Neurological drugs had the highest rate of having a generic equivalent, while oncology drugs had the lowest, according to the letter.

http://www.raps.org/Regulatory-Focus/News/2016/07/25/25388/FDA-Continues-Steady-Reduction-of-Generic-Drug-Application-Backlog/#sthash.ooWrwllF.dpuf

IT MAY GET WORSE

The FDA is trying to limit production lines to 1 or 2 drugs to improve safety.

2. New rules on labels may expose generic manufacturers to more lawsuits.

3. Consolidation is reducing generic competition in recent deals:

- Teva purchased the majority of Actavis generics from Allergan

- Dr. Reddy's got 8 drugs from Teva

- Endo acquired Par Pharmaceuticals

- Mayne acquired assets from Teva

- Mylan is purchasing Meda

- Meda purchased Abbott's generics

- Nichi-iko of Japan is acquiring Sagent

- Pfizer acquired Hospira

If you like this newsletter, please sign up to get a monthly email.

SIGN UP HERE TO KEEP GETTING THE NEWSLETTER:

https://www.robly.com/subscribe?a=09d720be69e6cff000f5ff54cdae0b0b

Or send a note at linda@pullanconsulting.com.