Pullan's Pieces #115 - May 2016 Territorial split deal, Infographic, University deals, Contract manufacturing risk

Pullan's Pieces #115

May 2016

linda@pullanconsulting.com | 1(805)-558-0361 | www.PullanConsulting.com

Global BD News for Biotech and Pharma

Dear Reader,

If you like this free monthly newsletter, please sign up here

https://www.robly.com/subscribe?a=09d720be69e6cff000f5ff54cdae0b0b or send me a note.

This month’s analysis below:

1. Analysis: Where to go for a Territorial split deal outside US and Europe?

2. Infographic: a pipeline in a product

3. Typical university deals

4. Case to Watch - does contract manufacturing risk the patents

See you at ASCO and BIO?

Cheers,

Linda

Analysis: Where to go for a Territorial Deal outside US and Europe?

Splitting an asset across a couple of territorials can be appealing for the owners of drug candidates.

The originator company may want to

• keep its home territory

• take advantage of domestic expertise or government favoritism

• or partner earlier for funds to develop further for bigger value in the bigger remaining territories.

So where to look outside the US and the big European markets (UK, Germany, France, Spain and Italy)?

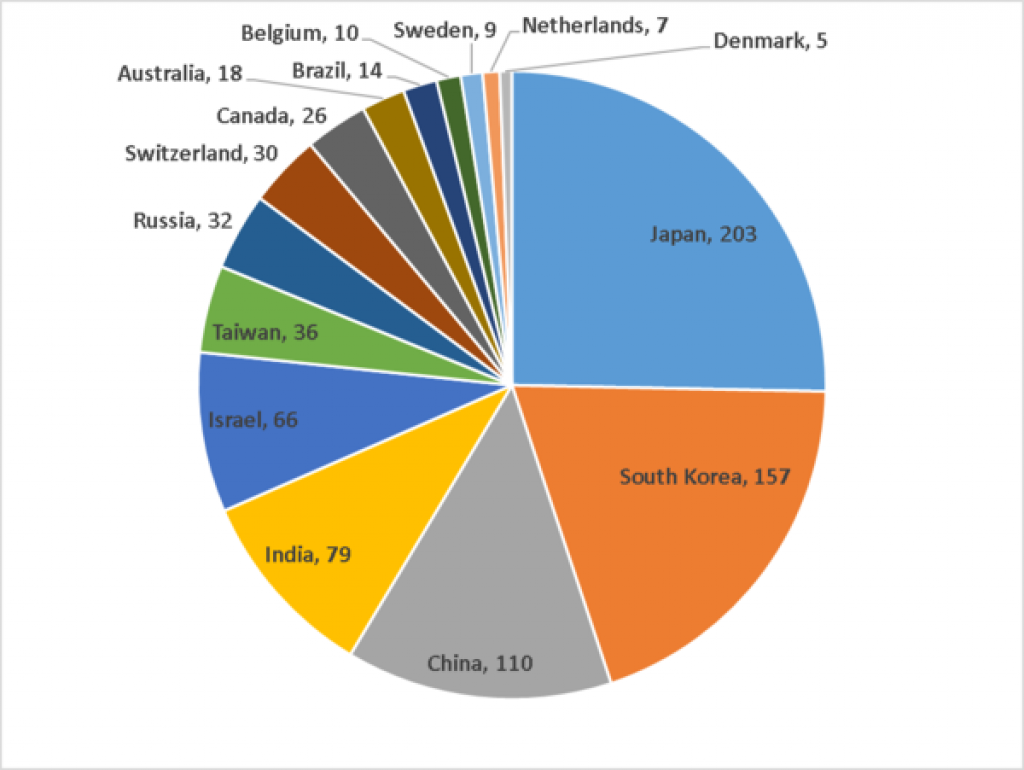

NUMBER OF IN-LICENSING DEALS By HEADQUARTER COUNTRIES

2011- PRESENT

excluding US and UK, France, Germany, Italy, Spain

Japan has long been a place to consider for a territorial split partnership. Companies with headquarters in Japan do more deals than other countries outside the US and the big countries of Europe. In the period since 1/1/2011, companies with headquarters in Japan have done 203 in-licensing deals, across all stages from discovery to market. Increasingly, however, many Japanese companies seek global deals, so many of these would not fit the territorial split model.

South Korea is 2nd with 157 in-licensing deals in the last 5 years or so.

The BRIC countries are a popular destination for territorial split deals. China is 3rd and India 4th in number of in-licensing deals, and companies with headquarters in Russia are 7th for in-licensing deals.

But Israel and Taiwan also do quite a number of in-licensing deals, ranking 5th and 6th.

Countries with fewer than 5 deals were excluded from the pie chart.

Interestingly, Israel is more active in out-licensing than in-licensing and Japan and Korea do about the same number of in- and out-licensing deals. China, India, Canada, Taiwan all do quite a bit of out-licensing but Russia and Brazil mostly do in-licensing.

All numbers pulled from Global Data May, 2016.

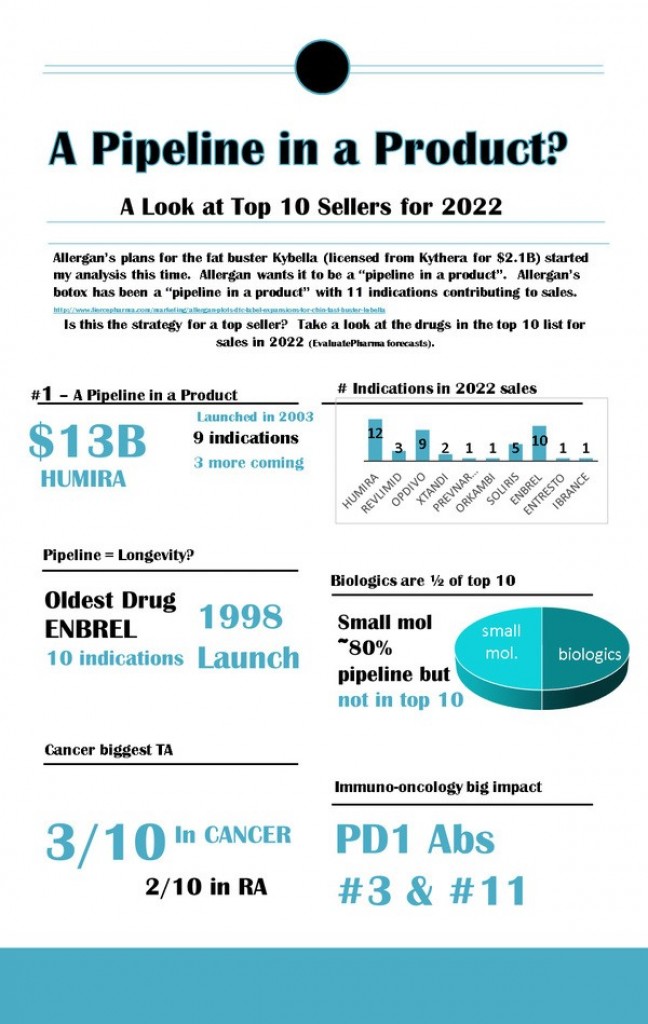

Infographic: A Pipeline in a Product?

Typical University deals

Great data from Mark Edwards and BioSciBD.

The typical (median) university/biopharma license has

• Upfront Cash of $80K,

• total Deal Size of $800K,

• a Maximum Royalty Rate of 3.5% of sales, and

• a 20-25% Share of Sublicensee Revenue.

However, due to a small number of much bigger deals, the average university/biopharma license has

• Upfront Cash of $1.1M,

• total Deal Size of $7.4M,

• a Maximum Royalty Rate of 4.2% of sales,

• plus a 17-27% Share of Sublicensee Revenue.

6% (6 of 108) of licenses have Upfront Cash in excess of $1M, and 8% (8 of 98) of licenses have a total Deal Size greater than $10M.

http://www.bioscibd.com/university-licenses

Case to Watch: Does contract manufacturing risk your patents?

Watch out for the upcoming ruling of the ruling by the US Court of Appeals for the Federal Circuit in Washington, D.C., in the case of "The Medicines Company v. Hospira". The Court of Appeals heard arguments May 5th on whether an inventor’s use of a third-party manufacturing service can invalidate the patentability of the invention.

The Medicines Company had lost its patent for Angiomax, a widely-used injectable anti-coagulant drug employed during most heart surgeries, which now accounts for the bulk of the firm’s sales.

Under US patent law, a patent can be rendered invalid if the invention was on sale more than one year before the date of the patent application. Commonly referred to as the “on-sale bar,” the provision is intended to prevent investors from extending a monopoly by selling their product for more than a year and then patenting it to gain an additional period of market exclusivity.

The hearing of all 12 judges (en banc) stems from a three-judge panel’s decision that a patentee’s use of a third-party manufacturer was equivalent to the sale of the invention from the manufacturer back to the inventor.

If the Federal Circuit determines that third-party manufacturing services do trigger the on-sale bar, it could have far-reaching consequences for companies that use third-party manufacturers. BIO and PhRMA joined the US Department of Justice, the American Intellectual Property Law Association, and the Intellectual Property Owners Association in filing briefs in support of overturning the application of the on-sale rule to 3rd party contract manufacturing.

http://polimedia.press/2016/05/05/federal-appeals-court-hears-case-that-may-impact-patent-rights-of-many-pharmaceutical-firms/

If you like this newsletter, please sign up to get a monthly email.

SIGN UP HERE TO KEEP GETTING THE NEWSLETTER:

https://www.robly.com/subscribe?a=09d720be69e6cff000f5ff54cdae0b0b

Or send a note at linda@pullanconsulting.com.