Pullan's Pieces #113-March 2016 Biomarkers analysis, average deals and fights over a decade

Pullan's Pieces #113

March 2016

Global BD News for Biotech and Pharma

linda@pullanconsulting.com | 1(805)-558-0361 | www.PullanConsulting.com

Dear Reader

The white paper for our webinars on What's Hot and What's Not in Immuno-oncology is out. It is full of big ideas, thanks to the great panelists. You can download it FREE from ShareVault. http://resources.sharevault.com/whitepaper-io-licensing-pc

This month’s Pullan’s Pieces analysis below:

1. Does big pharma always pay more than smaller companies?

2. Biomarkers and the time to wide use

3. The fight of the decade - PCSK9 Abs.

4. Changes in average deals over the last 10 years

See you in Stockholm for BioEurope Spring?

Cheers,

Linda

Are big pharma deal upfronts always bigger?

A bit of analysis of data available in Global Data shows that sometimes a smaller company pays as much as big pharma.

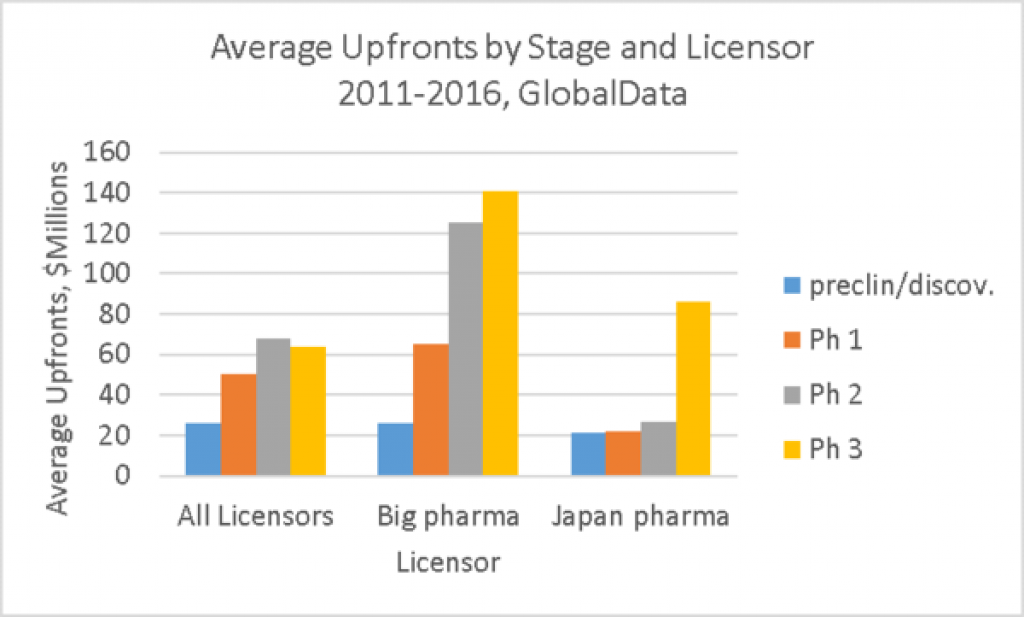

The graph above shows average upfronts by stage according to the acquirer of the license, for those deals with disclosed upfronts.

• For All Licensors, the size of the average upfront in partnership deals (from 2011 to 2016 inclusively) increases by stage of development when the deal is done. The average upfronts are $26M for preclinical/discovery deals, $50M for Phase 1, $68M for Phase 2, with a drop to $64M at Phase 3. This drop may indicate the best assets are taken at Phase 2 or that the challenges of commercialization with less lead time decreases the value.

• The average upfront paid by big pharma (>$10bn market cap including big biotech) increases by stage, with the biggest jump at Phase 2. There is not much extra value at Phase 3. This is what we think of as the classic deal pattern. But of note, there is no difference in the big pharma average upfront and the overall average upfront for preclinical/discovery deals. Big pharma does not always pay more.

• Japanese pharmas (HQ in Japan) paid less in average upfronts than did big pharma, but it is important to remember that many of these deals could be for Japan only versus global deals that predominate in big pharma and big biotech. It also makes some sense that the value spikes later in Japan (at Phase 3) as typically the development in Japan lags that of US and Europe, at least in part due to the need to pk studies in Asians.

All data pulled from GlobalData.

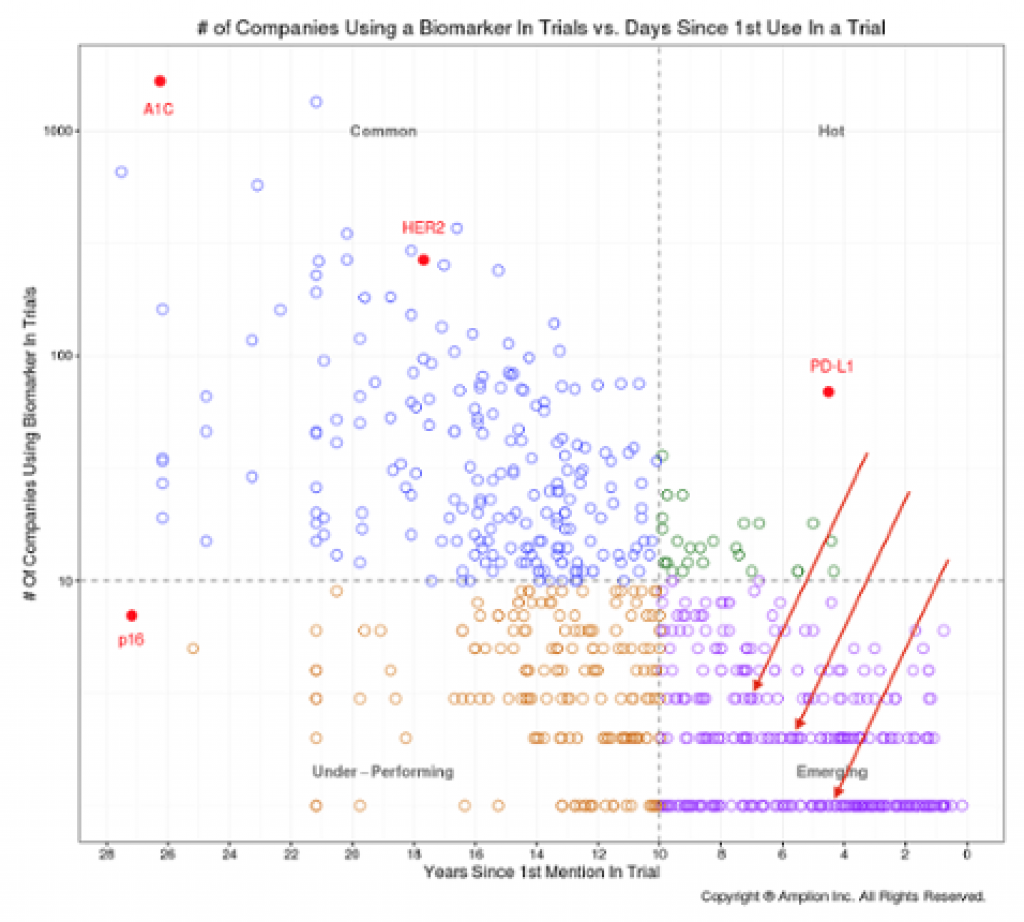

Biomarkers and the time to wide use

The biomarker analysis from Amplion is interesting.

http://www.amplion.com/biomarker-trends/chart-of-the-week-the-race-to-the-biomarkers-tipping-point

The fight of the decade continues - the PCSK9 battle

Amgen's Repatha versus Sanofi/Regeneron's Praluent are continuing a fight of the decade.

BIG POTENTIAL: Amgen and Sanfoi each have new cholesterol lowering agents, PCSK9 antibodies that have been forecast as blockbusters, with projections of combined sales of over $4B by 2020 (GlobalData).

EXPENSIVE DEVELOPMENT: These were huge expensive programs (6,000 plus patients at submission) and are still ongoing. The outcomes trial (FOURIER) for Repatha enrolled 27,500 patients and is just 1 of 31 trials listed for the drug (GlobalData).

EXPENSIVE DRUGS LAUNCH AT ~SAME TIME: Both drugs hit the market at just above $14,000 a year. Back in 2014, Amgen was expected to get the first approval, until Sanofi jumped ahead by paying Biomarin $67.5 million for the priority-review voucher Biomarin had received from the FDA for its rare disease drug. This voucher allowed Sanofi to gain FDA approval for its antibody Praluent in 6 months in July, one month ahead of Amgen's Repatha.

NARROW LABELS: The FDA limited both labels to smaller groups of patients than can obtain the drug in Europe. Of note, the drug makers did not win broad approval for physicians to prescribe PCKS9 inhibitors to patients who have not exhausted options at the highest doses of statins or who don’t want to take statins. A new study on the issue of stain intolerance and PCSK9 inhibitors scheduled to be presented at the upcoming meeting of the American College of Cardiology in Chicago, to be held April 2-4, 2016.

CONVENIENCE VS MARKETING? Repatha has monthly injections at higher dosages, and Praluent only offers bi-weekly injections. Doctors may view Repatha's single monthly dosage, which is more potent, as more convenient. Repatha can also be stored at room temperature for 30 days, thus offering another convenience factor over Praluent, which must be refrigerated after 24 hours. On the other hand, Sanofi has a larger marketing force with heart doctors, which may give it an edge.

PATENT FIGHT: Amgen sued Sanofi for infringement of Amgen's patents, with the potential to block the sales of Sanofi's drug if Sanofi was found to be infringing.

Amgen charged willful infringement based on documents in discovery, and the court allowed this to go forward, but this may be very hard to prove.

AMGEN WINS THE JURY TRIAL: The trial was scheduled for a jury trial in Delaware.

Now, the jury has decided that Amgen patents were valid.

YET TO COME: There is a scheduled hearing for a permanent injunction to stop the sale of Sanofi's Praluent but it is likely that the court will decide damages can be applied instead. Sanofi has said it will appeal the patent validity decision

http://seekingalpha.com/article/3724596-repatha-vs-praluent-will-amgens-patents-decide-race-prevailing-pcsk9-inhibitor

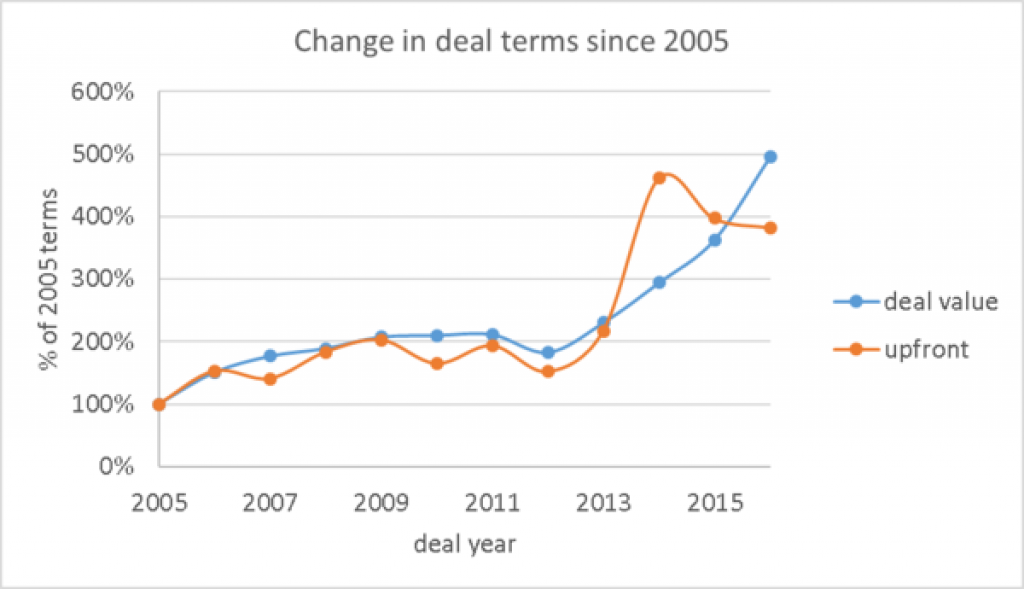

Average Deal Values Changing Over the Last 10 years

The average deal totals and the average milestones have gone up substantially in the last few years, while the number of deals done holds relatively steady.

The 2015 numbers were 1701 deals in strategic alliances and licenses, with 289 deals with disclosed deal terms, giving an average upfront of $59M and an average deal total of $259M across deals of all stages.

Data pulled from GlobalData.

If you like this newsletter, please sign up to get a monthly email.

SIGN UP HERE TO KEEP GETTING THE NEWSLETTER:

https://www.robly.com/subscribe?a=09d720be69e6cff000f5ff54cdae0b0b

Or send a note at linda@pullanconsulting.com.