Pullan's Pieces #114-Licensing deal analysis, Preferred partner, Continuous manufacturing

Pullan's Pieces #114

April 2016

Global BD News for Biotech and Pharma

linda@pullanconsulting.com | 1(805)-558-0361 | www.PullanConsulting.com

Dear Reader,

This is a short-term trial. I will not keep sending you this newsletter unless you confirm by clicking the link below or send me a note to tell me you want it!

SIGN UP HERE TO KEEP GETTING THE NEWSLETTER:

https://www.robly.com/subscribe?a=09d720be69e6cff000f5ff54cdae0b0b

If you missed the great IO whitepaper or if my link failed, please try again http://resources.sharevault.com/whitepaper-io-licensing-pc

This month’s analysis below:

1. Analysis: deal numbers by molecule type

2. Big Trend: continuous manufacturing

3. How to be a preferred partner

4. VCs raise big money but are in no hurry to spend it

See you in Suzhou for my first trip to ChinaBio?

Cheers,

Linda

Analysis: Licensing Deal numbers by type of molecule

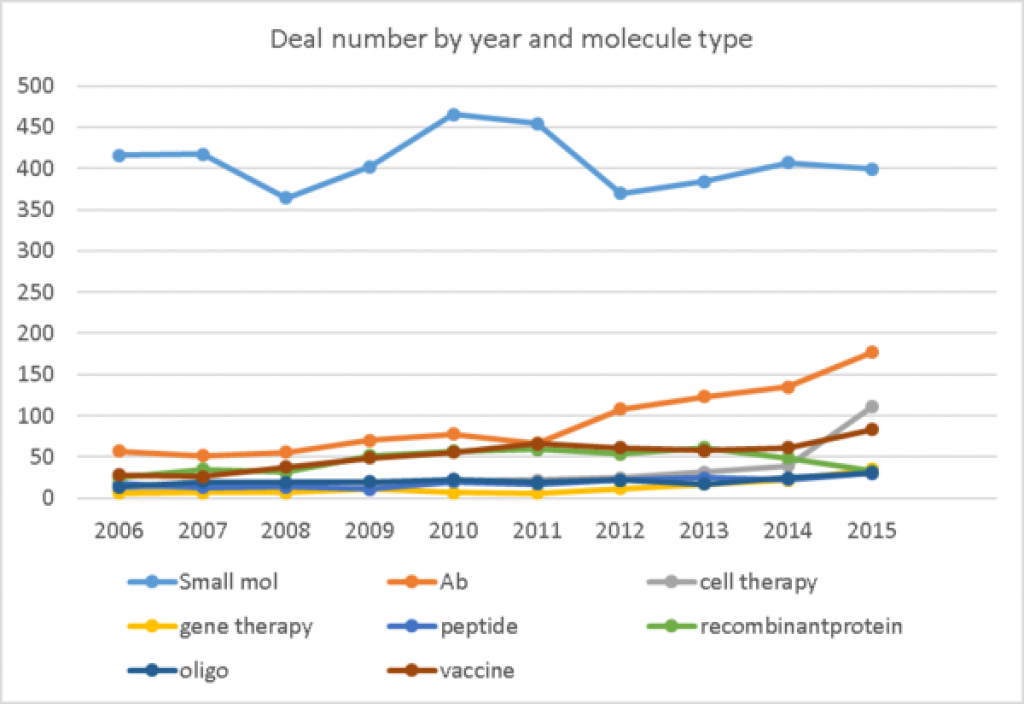

More licensing deals are done for small molecule drug candidate than for other molecule types, by far. But it is only about 2% of the molecules in the pipeline.

In the pipeline, from preclinical thru preregistration are 18,025 small molecules, 3539 antibodies, 2,202 recombinant proteins, 1488 cell therapies, 1035 oligonucleotides, 772 peptides, and 612 gene therapies in the pipeline.

Deals for antibodies (including ADCs) have increased in numbers over recent years and are a larger share of deals than of the pipeline. Deal numbers for cell therapies and gene therapy have ticked up recently and are a much larger share of deals than of the pipeline, while the number of deals for recombinant proteins dropped in 2015.

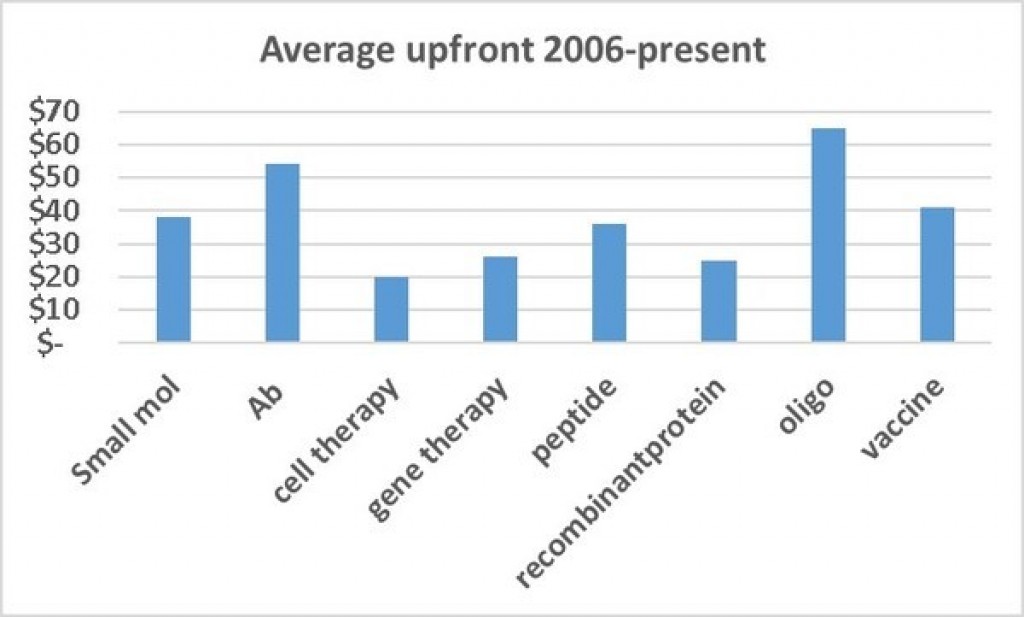

Deals for oligos are rare few in number but can be valuable. For example, in 2014, Ophthotech licensed from Novartis Fovista, a Phase 3 anti-PDGF oligo for AMD, for $200M upfront and over a $1B in total deal value. Also in 2014, Celgene licensed from Nogra a Phase 2 antisense against smad7 for Crohn's for $710M upfront and a total of up to $1.5B.

All numbers pulled from Global Data 4 19 2016.

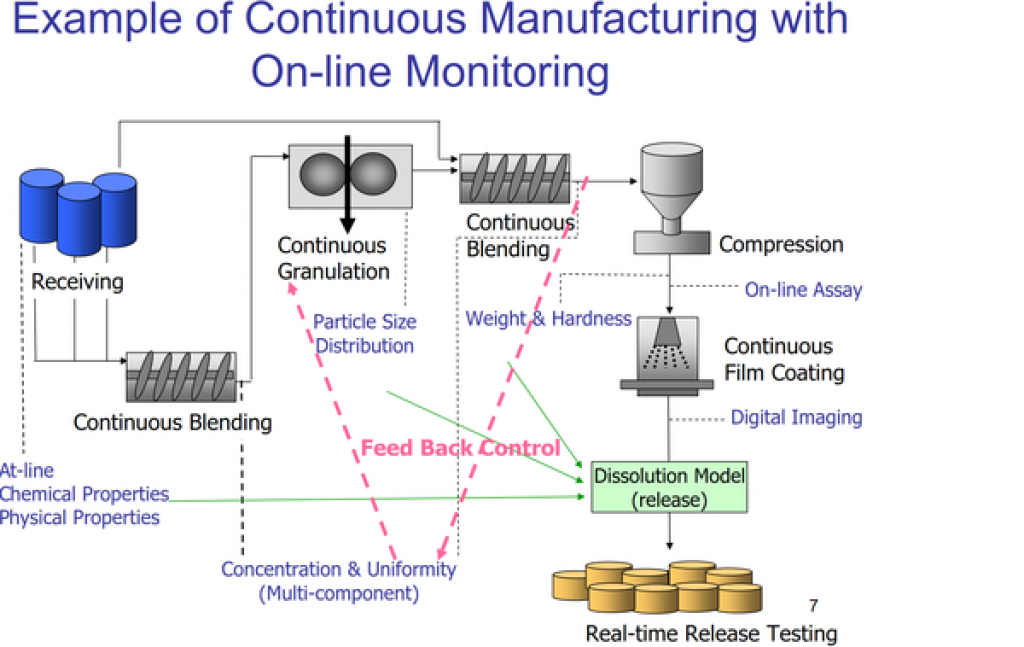

Now, a number of pharmaceutical companies have moved to continuous manufacturing to save money and time.

Lilly has also said it would build a continuous manufacturing facility in Ireland. GlaxoSmithKline is building a continuous manufacturing plant in Singapore. Vertex invested $30 million in a 4,000-square-foot continuous manufacturing facility in Boston, and its contractor, Hovione, will build one in New Jersey to supplement Vertex production.

http://www.fiercepharma.com/manufacturing/fda-urges-companies-to-get-on-board-continuous-manufacturing

How to be a preferred partner

Every big company talks of how they want to be the preferred partner for the best drugs coming from smaller companies. How can they do that?

Tell us what you want: Some companies are clear in what kinds of things are of interest and what are not- very helpful. Ideally, this is information should be on the company webpage and be quite explicit.

Provide contacts: Many of us hate the forms or, even worse, the emails to an impersonal drop box bd@companyx.com. Providing a name to send information is a start to building real relationships. Again, best practice is to have these on the webpages.

Acknowledge receipt of an opportunity: It seems rude to not even acknowledge an email or partnering meeting request. I know (all too well) dropped emails happen and it can be overwhelming to keep up. But in recent years, many emails go unanswered. A form response is better than no response.

Explain the process: Many times, the company offering the opportunity has not done all this before. And even for old hands, it is good to hear what the next step and its time-frame.

Provide feedback: It is true that most of the time, big companies will be saying "no thanks" to what is offered. But giving some reasoning behind the decision helps guide us to come back with additional data or not, and makes us feel as if you do value your potential partners.

Handle CDAs with grace: It is inevitable that sometimes CDAs take time to negotiate. But the recipients of the big company CDA process often are judging that this is what it will feel like to be negotiating a contract. It is an opportunity to sell the big company as great to work with.

Use speed as a competitive advantage: The partnering process is horribly slow so any speed can be a huge advantage. If you can decide before others, you can get ahead and stay ahead. And once an offer is made, it is hard to ignore in favor of an uncertain offer yet to come.

Partnering is still a people business. Our opportunities have so much complexity that this is far from an automated process. To be a preferred partner, remember the courtesies and treat the smaller company with respect. Japanese pharma lose on speed but are often seen as good partners because they value the relationships. But the images of a company as a preferred partner are built one interaction at a time.

VCs raised big money but are in no hurry to spend it

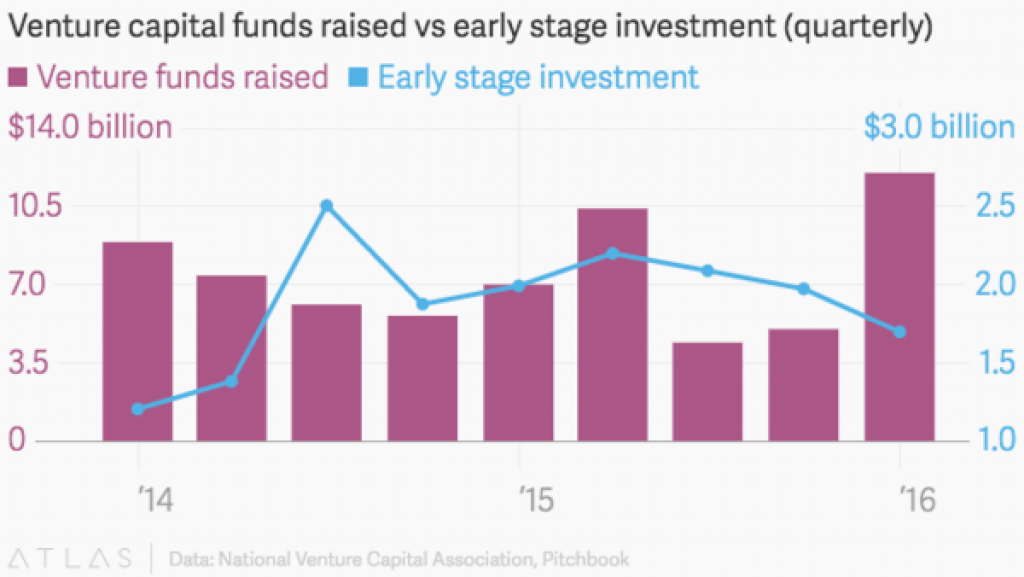

VCs raised more money in the first 3 months of 2016 than in any quarter over the last decade, according to the National Venture Capital Association. Their investors do not see many good alternative places to invest, with low-interest rates and stocks down.

But because companies will once again need to stay private longer with the tougher IPO market, VCs are saving much of their funds to keep adding to their existing companies. This means that despite big funds, it is hard to get that first round.

http://qz.com/662738/vcs-raised-the-most-money-in-a-decade-last-quarter-but-are-in-no-rush-to-invest-it/

If you like this newsletter, please sign up to get a monthly email.

SIGN UP HERE TO KEEP GETTING THE NEWSLETTER:

https://www.robly.com/subscribe?a=09d720be69e6cff000f5ff54cdae0b0b

Or send a note at linda@pullanconsulting.com.