Pullan's Pieces #112 February 2016 Deals, Funding, Pricing Pressure, power of predictive models

Pullan's Pieces #112

February 2016

linda@pullanconsulting.com | 1(805)-558-0361 | www.PullanConsulting.com

Science and Business News for the Biotech and Pharmaceutical Industry

Dear Reader,

I'd love to hear what you think of this month's stories.

Please check out the stories below

1. Which of the big companies does the most deals in your therapeutic area?

2. Stock prices, IPOs and their impact on funding and deals

3. Pricing pressure brings discussions on March-in rights, Medicare Part D negotiations, and transparency

4. The power of predictive models greater than throughput

See you in Stockholm for BioEurope Spring?

Cheers,

Linda

Who do the most deals in your therapeutic area?

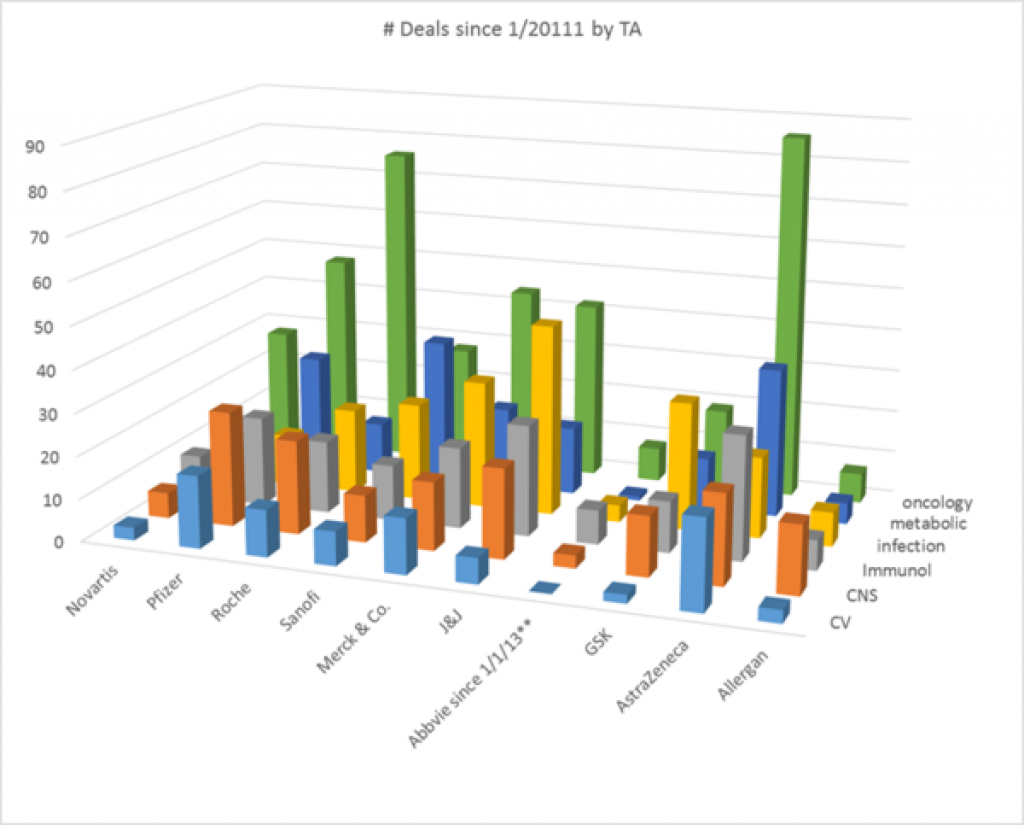

Here is a graph of the number of deals done since 1/2011 by top 10 pharma companies (by sales) in the top therapeutic areas. The companies are in order of sales with number 1, Novartis, on the left.

Oncology is the most active therapeutic area in a number of deals in the last ~5 years and cardiovascular the least active of these therapeutic areas. Among the top 10 companies, Abbvie only existed for 3 of the 5 years. AstraZeneca has more deals than expected for its size, especially in oncology, but also in cardiovascular, immunology, and metabolic disorders. Pfizer leads in the number of CNS deals. J&J leads in the number of infection deals.

All data pulled from GlobalData.

Stock prices and IPOs impact VCs and deals

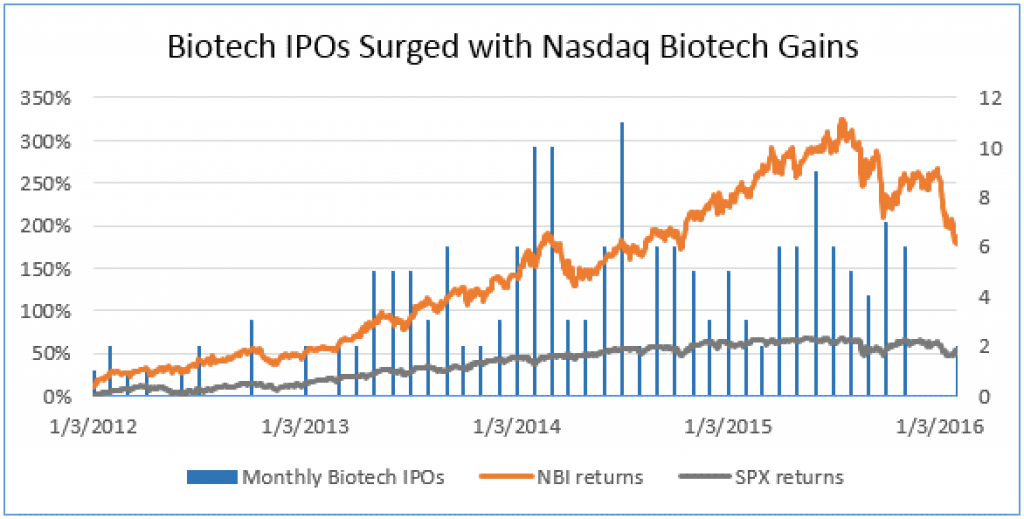

The Biotech stock index the IBB is down 34% from its high in July 2015. Of the 142 biotech IPOs since Jan 2013, 74% have seen their stock drop. For now, IPOs do not seem to offer VCs attractive exits and the public market looks to be a challenging place to raise money. Big biotechs and big pharma have seen their market values drop too.

But M&A has not been a good exit for VC-backed companies in recent years. The valuations may have been too high and the big companies may have been digesting their earlier acquisitions.

So VCs and other investors see exits as tough and will want to horde their cash to fuel their existing portfolio companies. If they see that exits are not getting done, they will be more price sensitive on any new investments.

http://www.bothsidesofthetable.com/2016/02/14/what-most-people-dont-understand-about-how-startup-companies-are-valued/

Good news is that VCs raised record funds in 2015 and private equity has lots of dry powder cash they will need to invest. And big biotech and big pharma need to do deals for pipelines and have increased their corporate venture activities. But big pharma licensing deal makers may well feel less sense of urgency as the alternatives are tougher for the out-licensors.

http://pitchbook.com/news/articles/28-of-us-pe-dry-powder-is-locked-up-in-vintages-from-2012-or-earlier

Until the IPO market comes back, young small companies will want to watch their burn, and allow longer times for fund-raising and deal making.

For the top tier of the companies who have done IPOs, they are cash rich with long runways. Some of these may be appealing take-overs by the big companies.

http://www.forbes.com/sites/brucebooth/2016/02/15/quantifying-the-carnage-biotech-ipo-markets-in-turmoil/#ba5d38d2176a

But M&A has not been a good exit for VC-backed companies in recent years. The valuations may have been too high and the big companies may have been digesting their earlier acquisitions.

So VCs and other investors see exits as tough and will want to horde their cash to fuel their existing portfolio companies. If they see that exits are not getting done, they will be more price sensitive on any new investments.

http://www.bothsidesofthetable.com/2016/02/14/what-most-people-dont-understand-about-how-startup-companies-are-valued/

Good news is that VCs raised record funds in 2015 and private equity has lots of dry powder cash they will need to invest. And big biotech and big pharma need to do deals for pipelines and have increased their corporate venture activities. But big pharma licensing deal makers may well feel less sense of urgency as the alternatives are tougher for the out-licensors. http://pitchbook.com/news/articles/28-of-us-pe-dry-powder-is-locked-up-in-vintages-from-2012-or-earlier

Until the IPO market comes back, young small companies will want to watch their burn, and allow longer times for fund-raising and deal making.

Pricing pressures in March-in rights, Medicare Part D, transparency....

Pricing pressure continues in many forms.

A group of lawmakers wrote a letter urging the HHS and NIH to use its "march-in rights" to address "price-gouging" by pharma companies. March-in rights under the Bayh-Dole Act would let US federal agencies license a patent (regardless of patents) when "action is necessary to alleviate health and safety needs which are not being reasonably satisfied [or] available to the public on reasonable terms."

http://www.raps.org/Regulatory-Focus/News/2016/01/11/23878/Lawmakers-Urge-HHS-to-Exercise-March-in-Rights-to-Fight-Higher-Drug-Costs/#sthash.Yd1dmKdm.dpuf

The White House 2017 budget includes a proposal to require price negotiations with Medicare Part D, the prescription drug program. This could lead to insurers demanding the same price, meaning government pricing. The White House budget proposal also includes a proposal to require transparency on R&D spending to justify pharmaceutical prices. Our industry has often pointed to the high cost of drugs including the cost of failures and the cost of capital. But that argument is not the right one to justify a price tag. In other areas, the consumer pays for purchases based on value delivered, not the cost of the components. http://www.latimes.com/business/la-fi-lazarus-20160216-column.html

BIO has recently joined PhRMA in working to improve the industry image with an ad http://timeisprecious.life/, a good, albeit late, step in helping change the argument on prices.

And all this pressure on prices makes pharma deal makers nervous which hurt the power of out-licensors in deal making.

Declining R&D productivity and predictive value of assays

Derek Lowe pointed to a paper using decision theory to address why explosions in chemical libraries and genetic assays have not increased the productivity of R&D leading to approved drugs.

http://blogs.sciencemag.org/pipeline/archives/2016/02/18/a-terrific-paper-on-the-problems-in-drug-discovery

The paper is tough reading and comments on Derek's column are often critical, but I think it really is worth reading and thinking about. What do you think?

The authors say that the low R&D productivity is due to low predictive values of models in predicting the later stage clinical outcome. They speak of the most predictive models as being exhausted by successful drugs. The use of a model with just a small decrease in predictive value requires a much larger increase in throughput of tested compounds to deliver a true positive. Increasing throughput by several orders of magnitude makes very little difference. And a series of assays for decision making may be less powerful than 1 somewhat more predictive model as there is a multiplication of the need for throughput, and a test can be well correlated with the other assay but not predictive of the later outcome sought. As Derek says, "A bad animal model is worse than no animal model".

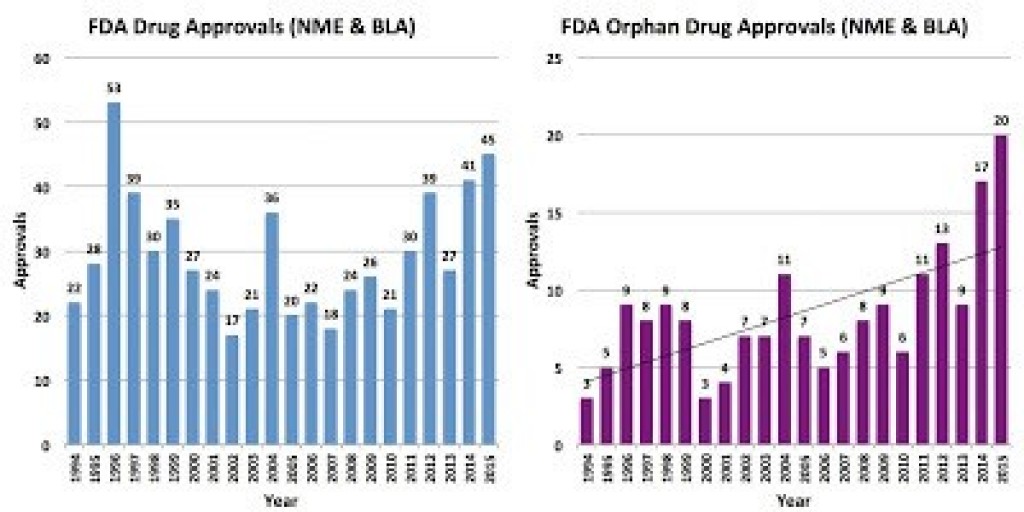

The authors suggest that the post-2012 uptick in approvals may be due to genetic signatures in tumor models and rare diseases.

Efficiency is easy to measure and manage and the predictive value of a new animal model can be an educated guess or intuitive qualitative assessment. But that assessment is more important than throughput.

The authors don't discuss how to gain confidence in the predictive value of a new assay, but there are those who would rely on human genetics and others who would argue for phenotypic assays. And making an assay easier to run fast (e.g., rapid xenograft growth) or for scale may cost more than it gains.

If you like this newsletter, please sign up to get a monthly email.

SIGN UP HERE TO KEEP GETTING THE NEWSLETTER:

https://www.robly.com/subscribe?a=09d720be69e6cff000f5ff54cdae0b0b

Or send a note at linda@pullanconsulting.com.